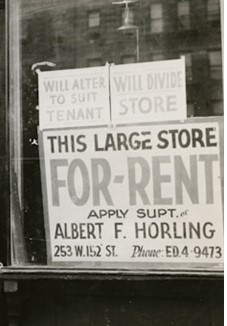

Leasing commercial real estate is a significant step for business owners, whether they are starting a new venture, expanding an existing business, or relocating to a new area. A commercial lease can be a complex document with various terms, rent structures, and responsibilities. Understanding these elements is crucial for making informed decisions and avoiding potential pitfalls. In this article, David Shulick discusses the key elements of commercial real estate leasing, common rent structures, and pitfalls to avoid to ensure a successful leasing experience.

Key Elements of Commercial Real Estate Leasing

Commercial real estate leases are legal agreements that outline the terms and conditions under which a business rents property from a landlord. Here are the key elements to consider when entering a commercial lease:

Lease Term

The lease term defines the length of time the lease agreement is in effect. Lease terms can range from a few months to several years. Shorter lease terms offer flexibility, allowing business owners to relocate or adjust their space needs more easily. Longer lease terms provide stability and can lock in favorable rental rates. Business owners should choose a lease term that aligns with their business goals and growth plans.

Rent Structure

The rent structure determines how much rent a business pays and how it is calculated. Common rent structures include:

- Gross Lease: The tenant pays a fixed rent amount, and the landlord covers most operating expenses, such as property taxes, insurance, and maintenance.

- Net Lease: The tenant pays a base rent plus additional expenses, which may include property taxes (net), insurance (net-net), and maintenance (triple-net).

- Percentage Lease: The tenant pays a base rent plus a percentage of their sales revenue. This structure is common in retail leases.

- Modified Gross Lease: A hybrid between gross and net leases, where certain expenses are included in the rent while others are the tenant’s responsibility.

Understanding the rent structure is crucial for budgeting and financial planning. Business owners should ensure they are aware of all costs associated with the lease.

Common Area Maintenance (CAM)

CAM charges cover the cost of maintaining common areas, such as lobbies, hallways, and parking lots. These charges are typically shared among tenants and can vary based on usage or square footage. It’s essential to understand what CAM charges cover and how they are calculated to avoid unexpected costs.

Tenant Improvements

Tenant improvements refer to any modifications or renovations a business makes to the leased space. Some leases include a tenant improvement allowance, where the landlord provides a budget for renovations. Business owners should clarify who is responsible for the cost of tenant improvements and ensure any changes comply with local building codes and lease restrictions.

Renewal Options and Exit Clauses

Renewal options allow tenants to extend the lease at the end of the term, often with predetermined rent increases. Exit clauses, such as early termination or subleasing options, provide flexibility if business needs change. Understanding these clauses is vital for planning future lease arrangements.

Common Pitfalls to Avoid in Commercial Leasing

While commercial leasing offers opportunities, it can also present challenges. Here are some common pitfalls to avoid when entering a commercial lease:

Overlooking Hidden Costs

In addition to base rent, business owners may face additional costs, such as CAM charges, property taxes, and insurance. Overlooking these hidden costs can lead to budget shortfalls. Review the lease agreement carefully to understand all expenses.

Ignoring Lease Restrictions

Commercial leases often include restrictions on how the space can be used, including limitations on signage, business hours, and modifications. Ignoring these restrictions can result in lease violations and potential legal issues. Always clarify any restrictions before signing the lease.

Failing to Negotiate Terms

Commercial leases are negotiable, and business owners should not be afraid to negotiate terms that better suit their needs. This could include negotiating rent, lease term, renewal options, or tenant improvement allowances. Failing to negotiate can result in unfavorable terms.

Not Reviewing the Lease with Legal Counsel

Commercial leases are legally binding documents, and it’s essential to review them with legal counsel before signing. An attorney can identify potential risks, explain complex terms, and ensure the lease aligns with business goals.

Conclusion

Leasing commercial real estate is a significant commitment for business owners, requiring careful consideration of various elements. Understanding key lease terms, rent structures, and common pitfalls is crucial for a successful leasing experience. By taking the time to review the lease thoroughly, negotiate favorable terms, and consult with legal counsel, business owners can enter a lease agreement with confidence and set their business on a path to success.